This post will explain claims management software. According to analysis, one out of every ten insurance claims is fraudulent, and US insurance companies estimate that fraud costs them an average of $40 billion annually. Due to the complexity of the claims management process, claims that are rejected, delayed, or fraudulently filed may come from gaps in the documentation, false claims, or mismatched quotes.

In order to digitally revolutionise the evaluating and settlement of insurance claims and ensure swift and transparent reimbursements, insurance companies are increasingly using claims management software with cutting-edge AI-automation technologies. In-depth information about claims management software, its capabilities, and the best software on the market are all covered in this blog post as it relates to the digital transformation initiatives of P&C providers.

A Claims Management System: What Is It?

Enterprise insurance companies and independent insurers support agents in managing the claims of their clients by using insurance claims management systems.

With a consolidated record system, it primarily facilitates the knowledge and information necessary for analysing claims.

Through the use of digital claims, these apps increase operational effectiveness, lower the cost of claims management, and automate insurance operations.

By monitoring the authorization process and ensuring that all claim information, including litigation, policy terms, and claim evaluations, is documented inside a centralised system, claims management software reduces false claims.

Additionally, insurance claim software improves case management, automates calculation and payment, and offers superior overall claim analytics.

P&C Claims Management Software Features

Numerous elements in claims management software are intended to lead users through the automated procedure.

The following are the key components of P&C claims management software:

- Electronic Claims: This function makes it easier to submit claims online and securely keeps them in the cloud.

- Claims Tracking: By standardising the workflow management for all incoming claims, claims tracking.

Users of claims management software can also change already-created or specially-tailored workflows to suit the requirements of a service provider.

- Document Management: By storing and organising important claims-related documents in the claims management process, claims management software aids insurers in managing their documentation needs.

- Reporting & Analytics: Claims management is a data-intensive process that may be studied to show areas for improvement, such as processing speeds, to give users of P&C platforms useful information about managing claims.

- Customer Relationship Management (CRM): To examine the customer information during the claims management process, claims management solutions tightly interact with CRM applications.

- Risk Assessment & Fraud Detection: This function is extremely important since it enables insurers to evaluate the claims’ risk.

Insurance companies can spot and handle fraudulent claims more effectively by cross-referencing information from numerous sources.

- Payment Processing: Thanks to payment processing features, insurers can monitor the claim’s payment totals in real time and make online payments.

- Integration: Managing many claims simultaneously and importing them from several insurance providers is made possible via EDI data exchange integration.

- Customer portals: Customers can submit and view their claims conveniently online with the help of customer portals.

Nine of the Best Claims Management Software for 2022

Here are the top P&C businesses’ claims management tools for automating claims and delivering quicker, more compliant claims processing:

1. BriteCore

For P&C insurers, BriteCore is a user-friendly cloud-based software platform that fosters digital innovation, digital transformation, and new business procedures. It provides a comprehensive insurance platform for managing policies, handling claims, underwriting, agent quotes and inquiries, managing contacts, invoicing, imaging, printing, data warehousing, and reporting. Also check Geographic Information System

For optimum security, effectiveness, and durability at scale, the software is delivered via Amazon Web Services and is continuously updated.

2. Guidewire ClaimsCenter

California-based Guidewire Claim Software Solution provides an automated end-to-end insurance claims management system called ClaimsCenter. ClaimCenter is a tool for personal, business, or workers’ compensation claims that was created to do away with the necessity for tedious claim management duties.

Guidewire was identified by Gartner as a leader in GMQ 2016 and was suggested as a tool for managing cross-departmental operations, cutting expenses, fostering teamwork, and monitoring performance.

Billing and Invoicing, Broker/Agent Portal, Claims Management, Customer Portal, Insurance Rating, Policy Management, Reinsurance Administration, and Underwriting Management are some of the features that Guidewire offers.

3. Applied Epic

A cloud-based agency management system called Applied Epic offers strong automation features and comprehensive business visibility.

To effectively handle customer policies and benefits, sales automation, and financial accounting procedures, it is a single open application that interfaces seamlessly with your current CRM solution.

Contract Lifecycle Management, Policy Management, Claims Management, Payments Processing, Sales Enablement, Invoicing & Receipts, Reporting & Dashboards, Payment Processing, Email Integration, and Task Management are a few of Applied Epic’s standout features.

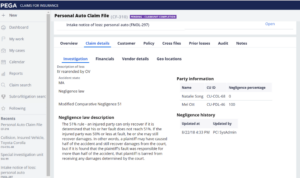

4. Pega Claims Management

Pega Claims Management Platform is an intuitive claims management system that updates your underwriting environment on an enterprise-wide scale while increasing the efficiency and efficacy of claims management.

Insurance companies can use it to build dynamic, intelligent business rules that power automated, agile end-to-end claims processes.

5. FileHandler Enterprise

A scalable and user-friendly claim administration system called FileHandler Enterprise is intended to automate and streamline the workflow for claims and risk management enterprises.

By offering tools like reporting and analytics, business intelligence, and security measures to provide a flawless claims management experience, the FileHandler Enterprise solution creates a new standard in the insurance sector.

The system was created on a Microsoft platform.

It enables professional employment organisations (PEOs) to display important operations with date and time stamps and schedule notices about important updates or claims-related duties. To further enhance claim verification, teams can upload attachments and photographs using the optional imaging tool.

Case management, claim resolution tracking, customer management, co-pay and deductible tracking, form management, policy administration, and risk assessment are some of the main functions of this software.

6. Snapsheet

Because of its innovative claims management, Snapsheet is a leader in the insurance sector. It makes it possible to deploy the quickest digital claims procedure for auto insurance. As a dependable business partner, Snapsheet collaborates with over 100 clients, including many of the biggest insurance companies, TPAs, MGAs, insurtech startups, and disruptors of the sharing economy. Also check donation software

It is cloud-based claims management software with an emphasis on interaction, digitization, and intelligent workflow automation. Through its Snapsheet Cloud software suite and Appraisal Services services, it offers unmatched software and processes to improve customer experience, boost corporate agility, and generate transformational benefits.

Among Snapsheet’s primary features are: adjustor management, claims tracking, electronic claims, and forms management.

7. LexisNexis Carrier Discovery

At key stages of the claims process, LexisNexis Carrier Discovery identifies crucial insurance carrier information. It helps with call centre scripting and improves the accuracy and effectiveness of the adjustment process throughout the claim settlement process.

The software successfully enhances the claim course change, policy management, adjustment procedure, and detection of fraudulent claims.

8. A1 Tracker

Web-based insurance software that supports all types of insurance, A1 Tracker is simple to use. The software instance can be customised by insurers by letting them select a language, currency, and hosting choice. Insurance companies are able to keep track of policies, applications, premiums, certificates, renewals, billing, payments, commissions, and sales prospects thanks to the software.

The following features are available through A1 Tracker: Audit Management, Billing & Invoicing, Broker / Agent Portal, Business Process Control, Commission Management, Compliance Management, Contract Management, Corrective and Preventive Actions (CAPA), Customer Management, Co-Pay & Deductible Tracking, Claims Management & Tracking.

9. 360SiteView

A computerised no-code insurance claims platform from 360SiteView keeps track of every participant’s activity.

Through supply-chain orchestration and end-to-end automation, expenses are further reduced, enabling them to relate to and reassure customers. Also check software companies in washington dc